U.S. Accounts for Over One Fifth of Total Outbound Investment from China

Los Angeles, 2015-7-23 — /EPR Retail News/ — Chinese outbound capital flows into global commercial real estate markets have exceeded US$10 billion in a year for the first time ever, according to the latest research from CBRE Group, Inc.

Over the past four years annual China-sourced outbound flows to commercial real estate experienced a compound annual growth rate (CAGR) of approximately 72 per cent to reach over US$10 billion 1 for the year 2014. China accounted for over one quarter of total outbound commercial real estate investment from Asia during 2013 and 2014.

The past two years have seen a dramatic rise in outbound capital flows into real estate from Chinese institutional, corporate and High Net Worth Individual (HNWI) investors. What began with China’s sovereign wealth funds (SWFs) and tier-one insurers purchasing high-profile trophy assets abroad has now spread to acquisitions by mid-tier insurers and corporate investors. Chinese real estate developers have also been active, expanding into overseas markets in a bid to meet increasing demand from mainland HNWIs for residential assets in key destinations.

Cities in the U.K., the U.S., and Australia have become the top three markets for mainland Chinese investors in terms of commercial real estate investment. Initial purchase activity has largely focused on residential, premium office and hotel assets in gateway cities.

“The explosive growth in purchases of offshore real estate by Chinese investors has presented a new class of investor to global markets. Opportunity has drawn these investors to some of the world’s most attractive real estate destinations; as these investors and developers gain experience and become more confident in overseas markets, we expect that an increasing amount will start to look for opportunities across a wider range of geographies and a greater variety of asset types,” said Chris Ludeman, Global President, CBRE Capital Markets.

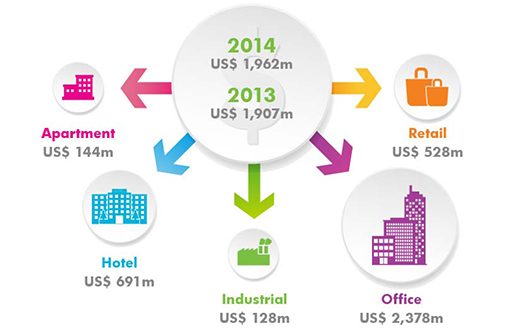

U.S.-bound flows accounted for over one fifth of total outbound investment from China in 2013 and 2014; the majority of which has gone to hotel and office assets, as well as development sites, in gateway cities. Over the two-year period, purchases of hotel and office assets in New York, Los Angeles, Chicago, Houston and San Francisco accounted for over 60 per cent of U.S.-bound capital to commercial real estate, with purchases of premium office and hotel assets in New York and Los Angeles comprising approximately half of the total.

“Chinese investors are only beginning to tap into the vast set of opportunities available to them in the U.S. As competition in gateway cities continues to increase, Chinese investors will need to include other large metropolitan areas, such as Atlanta, Boston, Dallas, Denver and Seattle in the hunt for better investment opportunities. Institutional investors are also beginning to take note of the attractive returns offered by industrial and logistics properties. As Chinese investors widen their search to new markets, they will also need to develop a more sophisticated understanding of local dynamics,” said Brian McAuliffe, Executive Managing Director, Americas, CBRE Capital Markets.

China outbound flows to US commercial real estate

UK-bound investment activity among Chinese corporate and institutional investors has placed most of its focus on large, prime office assets in core areas in London. Real estate acquisitions in London accounted for approximately 80 per cent and 52 per cent of total China-sourced commercial real estate investment flows to Europe in 2013 and 2014, respectively.

Australia has relied largely on the strength of its commercial ties with China, its largest trading partner. In 2014, China rose to become the second largest foreign purchaser of commercial property in Australia—behind only Singapore—with properties in Sydney the most attractive to Chinese investors.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2014 revenue). The Company has more than 52,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 370 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

For CBRE Capital Markets news follow us on:

Twitter: @CBREcapitalmkts

LinkedIn: CBRE Global Capital Markets

1 Figures only account for direct investment into commercial property, and do not include investment into development sites or individual investor purchases of residential property. Source: CBRE, Real Capital Analytics