Pasay City, Philippines, 2014-3-3 — /EPR Retail News/ — Philippines: SM Investments Corporation reports its 2013 net income grew 11% to PHP27.45 billion

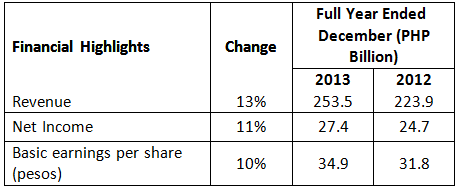

Financial Highlights

SM Investments Corporation (SM) reported that net income for the full year of 2013 grew 11% to PHP27.45 billion from PHP24.67 billion for the same period last year. Earnings growth was driven largely by the strong performance of BDO. Revenue increased 13% to PHP253.53 billion in 2013 from PHP223.88 billion in the previous year. EBITDA rose also by 11% to PHP60.90 billion, for an EBITDA margin of 24.0%. SM’s Annual Earnings per Share (EPS) stood at PHP34.85 up 10% year-on-year.

SM President Harley T. Sy said, “SM’s full year earnings for 2013 reflect the overall progressive economic environment of the country which, however, is tempered by competitive dynamics and the effects of continuous climate change. With that in mind, SM is constantly evolving to take advantage of the enormous opportunities that are made available by a fast emerging economy. SM will remain focused on its core businesses of retail, property, and banking with portfolio investments in high-growth emerging sectors.”

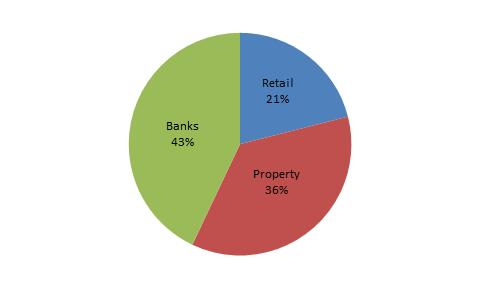

Net Income Profile

Of SM’s consolidated net income, banks accounted for the largest share, with a contribution of 42.8%. The property group, consisting of malls and real estate accounted for 35.9% while retail pitched in 21.3%.

Banking

BDO Unibank, Inc. (BDO) sustained its solid performance through the full year of 2013, as net income grew by 56% to PHP22.6 billion from PHP14.5 billion in the same period last year, in an environment marked by high system liquidity and volatility in the capital markets.

Gross customer loans increased by 19% to PHP911 billion on broad-based expansion across key markets. Meanwhile, total deposits accelerated by 44% to PHP1.3 trillion, led by steady growth in low-cost deposits as well as the inflow of maturing Special Deposit Accounts (SDA) funds from the Bangko Sentral ng Pilipinas (BSP). The growth in loans and deposits contributed to a 20% hike in net interest income to PHP43.2 billion. Further, non-interest income increased by 30% to PHP31.8 billion on the double digit expansion in both fee based income and trading and foreign exchange gains. The growth in operating expense, meanwhile, remained steady at 9.5%.

Property

SM Prime Holdings, Inc. (SM Prime), one of the leading property developers in Southeast Asia, reported combined net earnings of PHP16.27 billion in 2013.

The 8% growth in SM Prime’s consolidated recurring net income in 2013 of PHP17.54 billion was tempered by the one-time restructuring cost of PHP1.27 billion. This was related to the recent consolidation of SM’s property assets into SM Prime, making it the largest property company in the Philippines with interests in mall, residential, commercial and tourism development businesses.

Consolidated revenues rose 5% to PHP59.79 billion from PHP57.22 billion a year ago. Rental revenues accounted for 54% of the total, and grew by 11% to PHP32.20 billion from Php28.95 billion in 2012.

The increase was primarily due to the full-year effect of new malls opened in 2012, namely SM City Olongapo, SM City Consolacion, SM City San Fernando, SM City General Santos, SM Lanang Premier, and the opening in 2013 of SM Aura Premier. Excluding the new malls and expansions, rental revenues grew 7%. SM Prime’s shopping malls in China also sustained their profit growth, with net income amounting to PHP958 million.

SM Prime has 48 malls in the Philippines with a total gross floor area of 6.2 million square meters. In terms of mall expansions, SM Prime recently opened the SM Mega Fashion Hall which catapulted Megamall as its largest mall in the country. It is home to the flagship stores of the world’s most popular fashion brands Uniqlo, Zara and the much awaited Swedish retailer H&M, which will open its first store in the Philippines in the middle of the year.

SM Prime also operates five malls in China with a total gross floor area of 800,000 square meters. It will open SM City Zibo this year and SM City Tianjin in 2015 which spans 540,000 square meters and will be the largest mall in SM’s entire China portfolio.

Real estate condominium sales for 2013 stood at Php20.78 billion. Three projects were launched in 2013, namely: Grass Phase 2, Shore and Trees. These projects are expected to contribute significantly to revenues starting in 2014. Gross margins improved to 42% versus 37% in 2012.

Consolidated operating expenses increased by 12% to Php23.72 billion in 2013 while consolidated costs of real estate was at Php11.94 billion, a 15% decrease from Php14.02 billion in 2012.

Retail Operations

For 2013, SM Retail reported a net income of PHP5.6 billion. Sales, meanwhile grew 14% to PHP180.9 billion. SM Retail’s net margin stood at 3%.

At the end of 2013, SM Retail had a total of 241 stores, consisting of 48 SM Department stores, and 193 food stores, consisting of 39 SM Supermarkets, 39 SM Hypermarkets, 93 SaveMore stores, and 22 Walter Mart supermarkets.

Formerly called SM Department stores, “The SM Store,” signifies the business’s commitment to being the fashion store for all amid rapidly changing fashion trends, highly competitive local and global labels and increased purchasing power. In line with its rebranding, the business continues to roll-out new store designs and lay-outs to accommodate more brands and deliver an enhanced shopping experience.

The business has also embarked on imaging campaigns aimed at boosting brand equity with a rising generation of higher-spending, fashion-conscious Filipinos through celebrity endorsers, both local and international. Global fashion icons have included Sarah Jessica Parker, who visited Manila in May, and more recently, top British model David Gandy, who was a main highlight during Philippine Fashion Week. Local celebrities have included Anne Curtis, KC Concepcion, Sam Milby and Luis Manzano.

Along with the expansion of its store network, the Food Retail Group continued the refurbishment and renovation of its stores, introducing lay-outs designed for customers to find products even more easily.

The Food Retail Group also continued to widen the range of consumer choices by continually updating its product assortment. There was also increased collaboration between the Group’s SaveMore format and sister-company China Bank Savings, with the bank locating mini-branches offering a full range of services at SaveMore stores.

SM Balance Sheet

The total assets of SM increased 13% year-on-year to PHP632.98 billion. As of end-December 2013, SM maintains a very healthy balance sheet with a gearing ratio of only 37% net debt to 63% equity. On the parent company level, SM announced a few initiatives that will help broaden its investor base and also broaden its portfolio of investments.

In July 2013, SM, through its appointed depositary, The Bank of New York Mellon, launched its American Depositary Receipt (ADR) Level 1 program. Under the program, ADR securities issued in the US representing SM common shares can be traded over-the-counter with one SM ADR representing 0.5 common shares of SM. This facility allows US investors to trade SM common shares in their own time zone and to settle transactions locally, broadening SM’s shareholder base and enhancing SM’s international visibility.

On the investment front, SM acquired 90% ownership of CPI Asia Ten B.V. which owns and operates five commercial buildings in Global City at Fort Bonifacio, Taguig.

More recently, SM announced the acquisition of 34% equity of CityMall Commercial Center, Inc. with the remaining 66% held by DoubleDragon Properties Corp. which is a 50/50 joint venture between the founders of the Mang Inasal and the Jollibee Groups.

The investment is in line with SM’s objectives to expand community malls which will be put up initially in the Visayas and Mindanao regions.

# # #

For further information, please contact:

Ms. Corazon P. Guidote

Senior Vice President for Investor Relations

SM Investments Corporation

E-mail: cora.guidote@sminvestments.com

Tel. No. 857-0117