62% of large buildings qualify as green, compared to less than 5% of small buildings San Francisco closing in on Minneapolis in green market rankings

Los Angeles, 2015-6-25 — /EPR Retail News/ — Owners of small buildings have an opportunity to differentiate themselves by implementing energy-efficient practices, due to a significant gap between large and small office buildings in achieving sustainability certification, according to a new study by CBRE Group, Inc. and Maastricht University.

The 2015 Green Building Adoption Index, a joint project of CBRE and Maastricht, found that 62.1 percent of office buildings in the U.S. greater than 500,000 square feet are considered “green” (holding either an EPA ENERGY STAR label, U.S. Green Building Council (USGBC) full-building LEED certification or both). In contrast, only 4.5 percent of all U.S. office buildings less than 100,000 square feet qualified as green.

“Our 2015 study confirmed that green building adoption has been primarily a big building, first-tier city phenomenon,” said David Pogue, CBRE’s global director of corporate responsibility. “It would appear that many smaller buildings in the majority of large markets still have an opportunity to be ‘best in class’ among their peer set by achieving these certifications.”

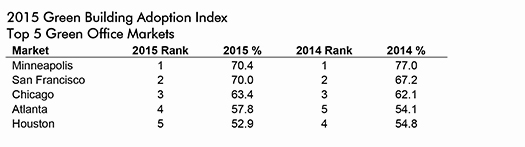

Minneapolis led the city ranking for the second consecutive year, with 70.4 percent of all office space currently qualified as green, down from 77.0 percent in 2014. San Francisco, again in second place, significantly closed the gap and now boasts a 70.0 percent green market, up from 67.2 percent in 2014. Chicago, at 63.4 percent, was third, while Atlanta (57.8 percent) and Houston (52.9 percent) swapped positions at fourth and fifth. The top 10 cities on the 2014 list all retained a place on the 2015 list.

The overall results of the study show that the uptake of green building practices in the 30 largest U.S. cities continues to be significant, but that the growth is slowing. At the end of the fourth quarter of 2014, 13.1 percent of the commercial building stock had an ENERGY STAR label, LEED certification, or both, compared to 13.8 percent at the end of 2013. Measured by size, the amount of certified commercial space also decreased from 39.3 percent in 2013 to 38.7 percent at the end of 2014.

“This decrease does not imply that buildings are starting to perform worse than before. Rather, it reflects the fact that only a certain fraction of the building stock can obtain a green or energy-efficiency certification,” said Dr. Nils Kok, associate professor in Finance and Real Estate, Maastricht University (NL). “Additionally, it appears that some of the buildings that were previously certified did not renew their certification in 2014. This does not necessarily mean that the energy use of these buildings has changed, but that some owners and managers choose not to spend the time or expense to reapply for certification every year.”

Executed in close collaboration with the USGBC and CBRE Research, this is the second release of the annual Green Building Adoption Index. Based on a rigorous methodology, the Index shows the growth of ENERGY STAR- and LEED-certified space for the 30 largest U.S. office markets, both in aggregate and in individual markets, over the previous 10 years.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2014 revenue). The Company has more than 52,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 370 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

For Further Information

Christy Ingle

T +1 949 7258591

email

Corey Mirman

T +1 212 9846542

email