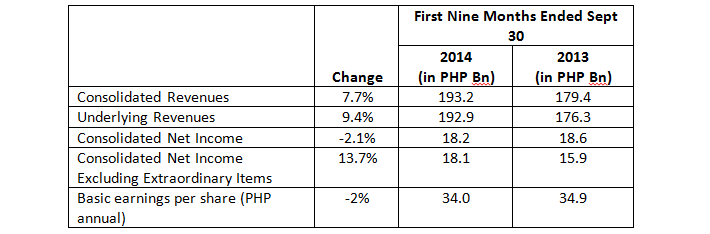

Pasay City, Philippines, 2014-11-6— /EPR Retail News/ — SM Investments Corporation (SM) reported a net income of PHP18.2 billion for the first nine months of 2014 from PHP18.6 billion during the same period last year. Consolidated revenues grew 7.7% to PHP193.2 billion in the period ended September 30 from PHP179.4 billion in the same period last year.

On a recurring basis, consolidated net income grew 13.7% to PHP18.1 billion from PHP15.9 billion. Underlying revenues also grew 9.4% to PHP192.9 billion from PHP176.3 billion. The reported net income in 2013 included exceptional items such as the trading gains in the Group’s banking businesses which boosted earnings of a number of banks during that period, among them BDO Unibank.

“We were able to sustain solid revenue growth across our core businesses of retail, banking and property. We also saw more robust real estate sales in the quarter with the launch of new projects. Our underlying profitability was driven by strong delivery of BDO and steady property contribution. In retail, gross margins have stabilized despite the intensifying competition, and we remain committed to expanding to new formats to tap the unserved and underserved markets,” SM President Harley T. Sy said.

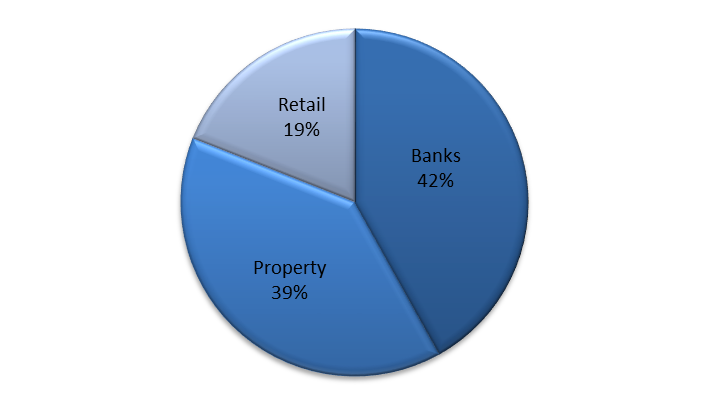

Net Income Profile

Banks accounted for 41.9% of SM’s consolidated net income in the first nine months and property accounted for 39.1% while retail contributed 19.0%.

Banking

BDO Unibank, Inc. (BDO) recorded a net income (attributable to equity holders of the parent) of PHP16.7 billion compared with PHP18.2 billion in the first nine months of 2013 which reflected non-recurring trading gains. BDO’s first nine months core income represents a 20% growth.

Net interest income in the first nine months grew 21% and continued to be the main earnings driver at PHP 37.5 billion. This is primarily due to the bank’s customer loan business which expanded 22% to PHP1.0 trillion. Total deposits registered PHP1.4 trillion, 18% higher than previous year.

BDO’s total capital adequacy ratio (CAR) of 14.1% and common equity tier 1 (CET 1) ratio of 12.7% under the current Basel III environment are well above the regulatory minimum of 10% and 8.5% percent respectively.

Property

SM Prime Holdings, Inc. (SM Prime) reported consolidated net income increased 11.8% to PHP13.5 billion in the first nine months from PHP12.0 billion in the same period last year. Consolidated revenues grew 8.5% to PHP47.8 billion in the January to September period from PHP44.0 billion the previous year.

Rental revenues accounted for 55% of the consolidated revenues, and grew by 11.2% to PHP26.4 billion in 2014 from PHP23.8 billion in the same period in 2013.

Same-store rental growth was at 7.0% in the first nine months.

The increase in rental revenue was primarily due to the new and expanded malls in 2013 and 2014 such as SM Aura Premier in Taguig, SM City BF Paranaque, Mega Fashion Hall in SM Megamall in Mandaluyong and SM Cauayan in Cagayan Valley with a combined 527,000 sqm. Part of the growth was from TwoE-comCenter in Mall of Asia Complex which opened in 2013 and is now fully occupied.

SM Prime recently expanded its malls in Bacolod and in Lipa, Batangas which contributed a combined 295,811 sqm to the company’s gross floor plate. In terms of commercial spaces, SM Prime topped off FiveE-ComCenter, a 15- level office building at the Mall of Asia Complex with a gross floor area of 125,716 sqm and approximately 85,000 sqm of leasable area. It also broke ground on ThreeE-comCenter, also a 15-storey building featuring semi-circular twin towers with a total GFA of 111,727 sqm.

These new office buildings will continue to establish the E-comCenters as a premier address in the Mall of Asia Complex in Pasay City given its ideal location and master-planned environment.

In the third quarter, real estate sales grew 18.1% to PHP3.4 billion, reversing the cumulative decline in the previous quarters. SM Prime’s residential development arm, SM Development Corp. (SMDC) posted a 12% increase in revenues to PHP3.7 billion in the third quarter from PHP3.3 billion a year ago. The strong performance was driven by more projects nearing completion, particularly Grace, Shell and Breeze Residences.

As of September, real estate sales comprise 33% of total revenues at PHP16.0 billion, slightly higher than the previous year’s PHP15.8 billion. SM Prime expects improved results as more condominium projects are completed. Thus far SMDC has 22 projects.

Cinema ticket sales rose 20.6% to PHP3.3 billion in the nine-month period from PHP2.7 billion in 2013 largely due to the international and local blockbuster movies shown as well as the opening of digital cinemas at the new and expanded malls.

Amusement and other revenues increased by 20% to PHP2.1 billion during the nine-month period. This was due to the strong patronage of amusement rides and additional recreational facilities in various malls.

In the third quarter, SM Prime successfully issued PHP20 billion in retail bonds with tenors of 5.5

years, seven years and 10 years. The bonds fetched fixed interest rates of 5.1000%, 5.2006% and 5.7417% respectively.

Retail Operations

For the first nine months of 2014, SM Retail’s net income grew 5.0% to PHP3.8 billion. Total sales rose 9.2% to PHP136.4 billion. SM continues to be a market leader in the Philippines. The food retail business in particular is on an aggressive expansion mode to penetrate the informal sector and both urban and rural communities. In the department store business, the SM Store continues to introduce fresh concepts and its expansion is on track in line with the completion of new SM malls.

At the end of the three quarters of 2014, SM Retail opened 16 new stores, bringing the total to 255 stores, consisting of 49 SM Stores, 40 SM Supermarkets, 41 SM Hypermarkets, 102 Savemore stores and 23 WalterMart stores. This year, the SM Store opened in Cauayan, Isabela. In terms of food retail stores, SM opened 15 new stores in various parts of Luzon, Visayas and Mindanao.

SM Balance Sheet

The total assets of SM grew 8.3% in the first nine months to PHP685.6 billion. As of end-September 2014, SM maintains a healthy balance sheet with a gearing ratio of 40% net debt to 60% equity.

SM raised PHP15 billion in May 2014 from a public offer of peso-denominated retail bonds with maturity of seven and 10 years. The SM bonds are rated PRS Aaa by Philippine Rating Services Corporation, the highest rating assigned by the credit rating firm.

In June 2014, SM issued a USD350 million 10-year senior unsecured bond at a fixed rate of 4.875% per annum, a landmark transaction marking the longest-dated USD bond issued by SM and the company’s fourth USD bond issuance since 2009. The issuance earned SM the Region’s Best Borrower Award from Hong Kong publication Finance Asia.

Recently, SM, BDO and SM Prime were awarded Asia’s Icon on Corporate Governance while China Banking Corporation was cited as one of among Asia’s Outstanding Companies on Corporate Governance by Hong Kong magazine Corporate Governance Asia. SM Vice Chairperson and BDO Chairperson Teresita T. Sy-Coson and SM Prime President Hans T. Sy were cited for the Asian Corporate Director award.

About SM Investments Corporation

SM Investments Corporation (SM) is one of the leading conglomerates in the Philippines with highly synergistic businesses in retail, banking and property development. SM has evolved into one of the highly respected companies in the country owing to its progressive approach in business and its comprehensive sustainability programs for its host communities through SM Foundation and SM Cares.

SM’s retail operations enjoy a strong brand franchise consisting of The SM Store and its food retail chains namely SM Supermarket, SM Hypermarket, Savemore and WalterMart stores. SM’s property arm, SM Prime Holdings, Inc. is among the largest integrated property developers in the Philippines with interests in mall, residential, commercial and tourism development. SM’s interests in banking are in BDO Unibank, Inc. (BDO), the country’s largest and in China Banking Corporation (China Bank), the fifth largest. Combined, these two banks have a network of over 1,000 branches nationwide.

For further information, please contact:

Ms. Corazon P. Guidote

Senior Vice President for Investor Relations

SM Investments Corporation

E-mail: cora.guidote@sminvestments.com

Tel. No. (632) 857-0117

www.sminvestments.com

###