Hong Kong Remains World’s Most Expensive Retail Market by Substantial Margin

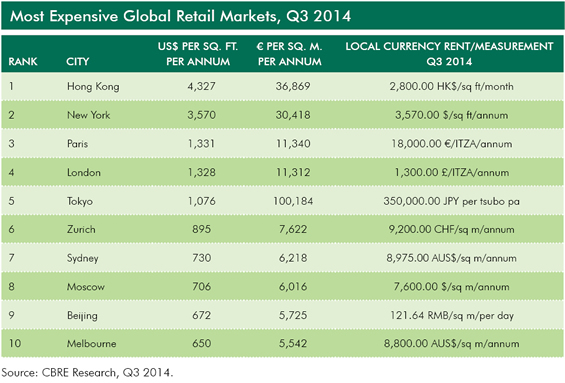

Los Angeles, 2014-12-8 — /EPR Retail News/ — Hong Kong, New York, Paris, London and Tokyo retained their positions as the world’s most expensive high-street retail destinations in Q3 2014, according to new research from global property advisor CBRE Group, Inc.

CBRE’s quarterly ranking of the world’s prime global retail markets saw little change in Q3 2014, with global and hot-growth markets continuing to lead the list. Retailers across all markets continue to target high-end shopping areas and international tourists.

“Even with the somewhat gloomy economic headlines, consumer demand is reasonably firm in most markets,” said Richard Barkham, Global Chief Economist, CBRE. “We can expect to see a continuation of the post-crisis pattern of periods of optimism followed by periods of pessimism. The Americas will see stronger growth than the Eurozone, as the latter has been constrained by restructuring in the banking sector as well as overly tight fiscal and monetary policy. Asia Pacific will record slightly lower growth in 2014 over 2013, but is still expected to outpace the other two regions by a considerable margin.”

Hong Kong (US$4,327 per sq. ft. per annum) maintained a wide lead over the number-two market, New York (US$3,570 per sq. ft. per annum)—where prime rent along Fifth Avenue is at record levels. Rents in Hong Kong remained stable compared to Q2 2014.

The “Occupy Central” protest, which began late in the third quarter, has not yet materially impacted retail rents in Hong Kong,” said Henry Chin, Head of Research, Asia Pacific, CBRE. “We did see lower shopper footfall in affected areas in October; however, the Christmas shopping season will provide some support to retail sales in the final quarter.”

A large rental spread also exists between New York and the two leading European markets: Paris (US$1,331per sq. ft. per annum) and London (US$1,328 per sq. ft. per annum). The gap between the top four markets and the rest of the top 10 widens significantly.

While the top four cities continue to hold their leading positions, there was some movement lower in the top 10 rankings. Rents rose in Tokyo (US$1,076 per sq. ft. per annum), and fell in Zurich ($895 per sq. ft. per annum) and Sydney (US$730 per sq. ft. per annum), resulting in the cities changing positions this quarter.

In Q3 2014, Tokyo continued to lead rental growth in Asia Pacific, with the continued lack of space in major high-street retail locations pushing up retail rents 7.7 percent quarter-over-quarter. Strong rental growth was also recorded in a number of emerging markets in the region, particularly in India and Vietnam, reflecting the recent resumption of structural economic reforms following the general lack of progress over the past few years. Highlights included a strong 5.9 percent quarter-over-quarter rental growth in Ho Chi Minh City and a 4.0% quarter-over-quarter rental growth in Mumbai.

Retailer demand for prime locations in major cities across EMEA remained firm, but rental growth has tailed off, leaving most markets flat in Q3 2014. Hamburg (up 6.5 percent quarter-over-quarter) and Munich (up 5.6 percent quarter-over-quarter) were among the few markets to record growth, reflecting the fact that, despite the recent economic headlines, domestic consumption in Germany remains firm.

In the U.S., four of the 12 prime retail corridors tracked by CBRE Research saw quarter-over-quarter increases in prime rents during Q3 2014. Prime asking rents along Rodeo Drive in Los Angeles (US$640 per sq. ft. per annum) continue to be the highest in the U.S. outside of Manhattan, and are expected to record further increases over the remainder of 2014, as there continues to be a lack of available space. Miami (up 3.2 percent quarter-over-quarter), Washington, D.C. (up 2.2 percent quarter-over-quarter), and New York (up 2.0 percent quarter-over-quarter) also reported increasing in prime asking rents in Q3 2014. In Canada, high-street rents were unchanged in Montreal, Vancouver and Toronto, and have remained at their current level since Q4 2013.

Note to editors/journalists: To speak with a CBRE retail expert please email robert.mcgrath@cbre.com orcorey.mirman@cbre.com

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2013 revenue). The Company has approximately 44,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through approximately 350 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

For Further Information:

Robert Mcgrath

Director, Sr

T +1 212 9848267

email

Corey Mirman

Specialist, Sr Communication

T +1 212 9846542

email