Arlington , VA, 2015-10-27 — /EPR Retail News/ — Earlier this month, lobbyists from the American Bankers Association (ABA) loudly asserted that an FBI consumer alert urging consumers to use PINs with newly issued EMV or “chip” credit cards was misguided, because banks in the United States were not issuing chip and PIN credit cards. A lead lobbyist for the ABA said flatly, “PIN is not going to be adopted in the U.S.” (Matt Hamblen, “FBI Takes Down Alert On Chip Credit Cards After Bankers Complain,” Computerworld 10/9/15)

First, we know this is not true. Smaller banks have in fact already announced that they will move to chip and PIN to better secure transactions and their customers. First Niagara Financial group made such a public announcement recently. (Robin Sidel, “Bank Bets Americans Can Remember Another PIN,” Wall Street Journal 10/1/15)

Target, one of the nation’s largest retailers, has also announced that its RedCard MasterCard will now be a chip and PIN card. (Matthew J. Schwartz, “Target Rolls Out Chip & PIN Cards,” Bank Info Security 10/14/15)

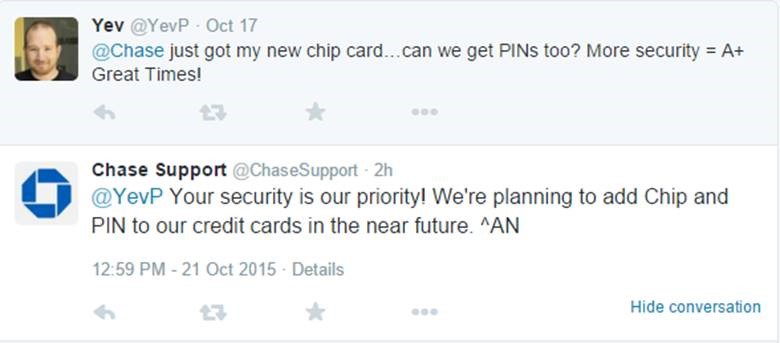

And now, JPMorgan Chase, one of the largest issuers of credit cards in the United States, has told a customer that Chase was indeed planning to add PINs to credit cards.

So who is telling the truth?

If the lobbying association representing the country’s largest banks did indeed tell the FBI that no banks are issuing PINs in the United States, how does that square with what one of the largest credit card issuers in the nation is telling its customers?

###

Jason Brewer

Senior Vice President, Communications and Advocacy

Phone: 703-600-2050

Email: jason.brewer@rila.org