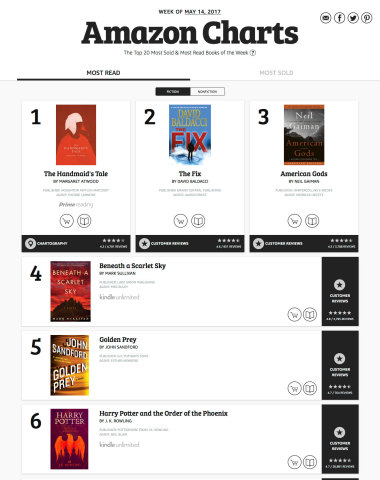

Amazon shares which books are being read and sold the most through its newly launched Amazon Charts

A reimagined bestseller list that shares how we read today

SEATTLE, 2017-May-19 — /EPR Retail News/ — Amazon today (May 18, 2017) launched Amazon Charts, a reimagined weekly bestseller list that shares which books are being read the most and…