Three of Five Priciest Markets are in Asia; Five of 10 Fastest Growing Occupancy Cost Markets are in U.S.

Los Angeles, 2014-12-19 — /EPR Retail News/ — London’s West End remained the world’s highest-priced office market but Asia continued to dominate the world’s most expensive office locations, accounting for three of the top five markets, according to CBRE Research’s semi-annual Global Prime Office Occupancy Costs survey. The study also found that prime rents are rising fastest in the Americas, where real estate fundamentals continue to improve. Overall, the U.S. accounted for five of the 10 markets with the fastest growing prime occupancy costs. These markets were Seattle (Suburban), San Francisco (Peninsula), Boston (Suburban), San Francisco (Downtown) and Seattle (Downtown).

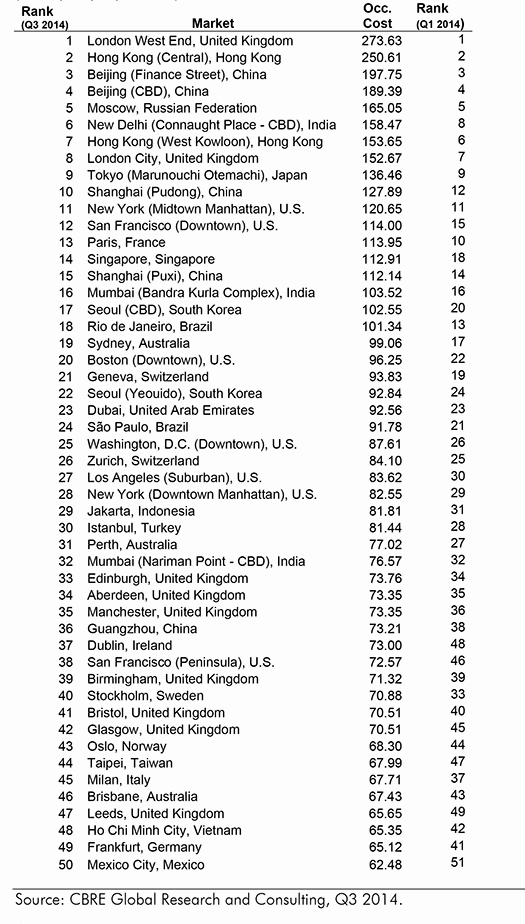

London West End’s overall prime occupancy costs of US$274 per sq. ft. per year topped the “most expensive” list. Hong Kong (Central) followed with total prime occupancy costs of US$251 per sq. ft., Beijing (Finance Street) (US$198 per sq. ft.), Beijing (Central Business District (CBD)) (US$189 per sq. ft.) and Moscow (US$165 per sq. ft.) rounded out the top five.

The change in prime office occupancy costs mirrored the gradual, multi-speed recovery of the global economy. Global prime office occupancy costs rose 2.5 percent year-over-year, led by the Americas (up 4.1 percent) and Asia Pacific (up 2.8 percent). Meanwhile, EMEA was essentially flat, edging up 0.3 percent year-over-year.

“We expect the gradual recovery of the global economy to continue, leading to better hiring rates and further reduction in the availability of space across most markets over the near term,” said Richard Barkham, Global Chief Economist, CBRE. “In this environment, we expect occupancy costs to continue rising from current levels, further limiting options for occupiers. Technology, quality and flexibility are expected to increasingly come into consideration in space use and location decisions, as occupiers will seek to contain costs and improve productivity.”

CBRE tracks occupancy costs for prime office space in 126 markets around the globe. Of the top 50 “most expensive” markets, 20 were in EMEA, 20 were in Asia Pacific and 10 were in the Americas.

Europe Middle East & Africa (EMEA)

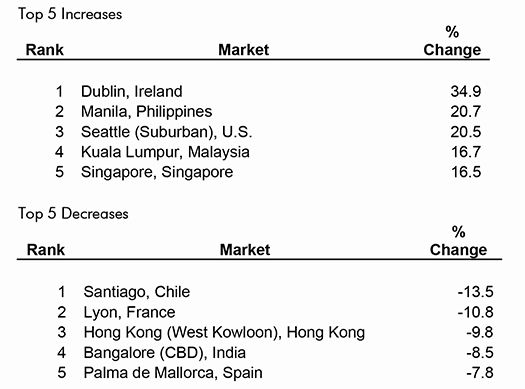

The Eurozone’s tepid economic recovery has held back occupier activity, resulting in static prime occupancy costs in most core European markets. The region’s 0.3 percent year-over-year increase in prime occupancy costs was primarily driven by buoyant conditions in U.K. cities, most Nordic markets, and the strong recovery of the Dublin office market. The main decreases have been in central European markets, such as Warsaw (down 1.6 percent), where the economies are relatively healthy but new supply has driven down rents. In only a few markets, notably Dublin (up 34.9 percent) and London, a robust recovery in occupier demand coincided with a lack of new supply.

In addition to London West End, other markets from the region on the global top 10 list were Moscow (US$165 per sq. ft.) and London City (US$153 per sq. ft.).

Asia Pacific

Asia Pacific had 20 markets ranked in the top 50 most expensive, including seven of the top 10—Hong Kong (Central), Beijing (Finance Street), Beijing (CBD), New Delhi (Connaught Place – CBD), Hong Kong (West Kowloon), Tokyo (Marunouchi Otemachi) and Shanghai (Pudong). Occupier activity in the region was largely driven by domestic corporations and companies in the technology, media and telecommunications sectors. Half the markets saw costs increase above 1 percent.

Hong Kong (Central) remained the only market in the world—other than London’s West End—with a prime occupancy cost exceeding $200 per sq. ft.

The most expensive market in the global ranking from the Pacific Region was Sydney (US$99 per sq. ft.), in 19th place.

Americas

In the U.S., where the economic recovery has firmly taken hold, strong leasing activity led to the highest level of quarterly net absorption since 2007, driving above-inflation increases in prime occupancy costs across all but one major U.S. market. Additionally, increasingly broad-based rising hiring rates have boosted demand for office space.

Eight North American markets recorded double-digit increases in prime occupancy costs in Q3 2014, and the top six growth markets in the Americas were all U.S. cities.

New York Midtown, the 11th most expensive market in the world, remained the most expensive Americas market, with a prime office occupancy cost of US$121 per sq. ft.

Rio de Janeiro remained the most expensive market in Latin America, posting an office occupancy cost of US$101 per sq. ft. and ranking as the 18th most expensive market globally.

Top 10 Most Expensive Markets

(In US$ per sq. ft. per annum)

Largest Annual Changes Occupancy Costs

(In local currency and measure)

Note: The full Top 50 Most Expensive Markets chart is located at the end of this press release.

Notes

- The Global Prime Office Occupancy Costs report is a survey of office occupancy costs for prime office space in 126 cities worldwide.

- The latest survey provides data on office rents and occupancy costs as of September 30, 2014.

- The Largest Annual Changes rankings are based upon occupancy costs in local currency and measure. The Most Expensive ranking is based upon occupancy costs in US$ per sq. ft. per annum.

- The figures given in this release refer to occupancy cost. This represents rent, plus local taxes and service charges. The occupation cost figures have also been adjusted to reflect different measurement practices from market to market.

- Due to methodology changes, comparisons with figures in previously released reports are not valid.

- To obtain a full copy of the report or to arrange to speak with a CBRE expert, please contact Robert McGrath (robert.mcgrath@cbre.com) or Corey Mirman (corey.mirman@cbre.com).

Top 50 Most Expensive Office Markets

(In US$ per sq. ft. per annum)

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2013 revenue). The Company has approximately 44,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through approximately 350 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

###

For Further Information:

Robert Mcgrath

Director, Sr

T +1 212 9848267

email

Corey Mirman

Specialist, Sr Communication

T +1 212 9846542

email