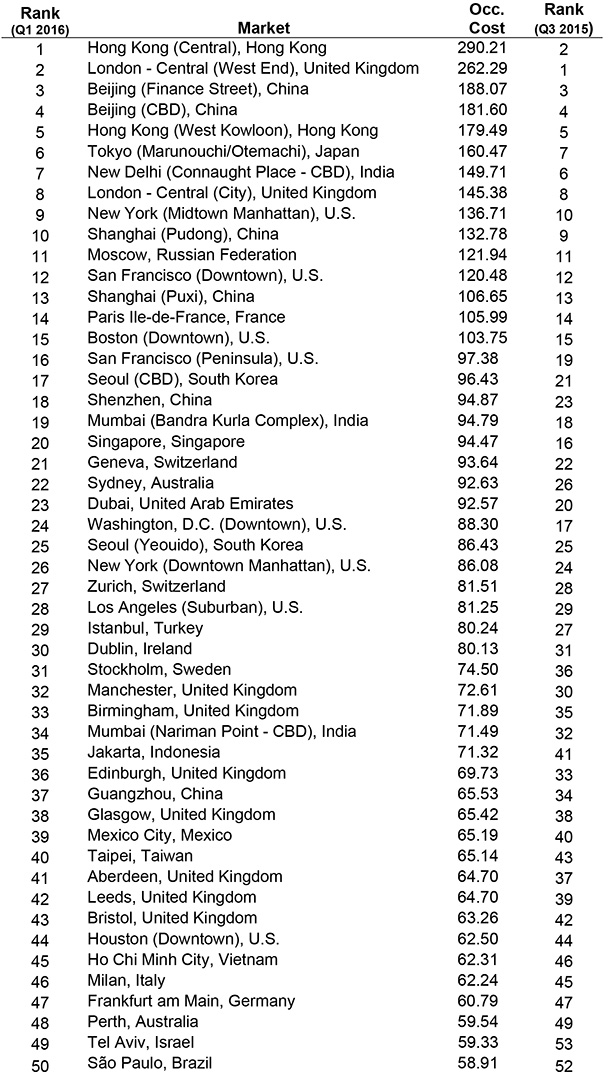

LOS ANGELES , CA, 2016-Jun-15 — /EPR Retail News/ — Hong Kong has become the world’s highest-priced office market and Asia continued to top the list of the world’s most expensive office locations, accounting for four of the top five markets, according to CBRE Research’s latest semi-annual Global Prime Office Occupancy Costs survey.

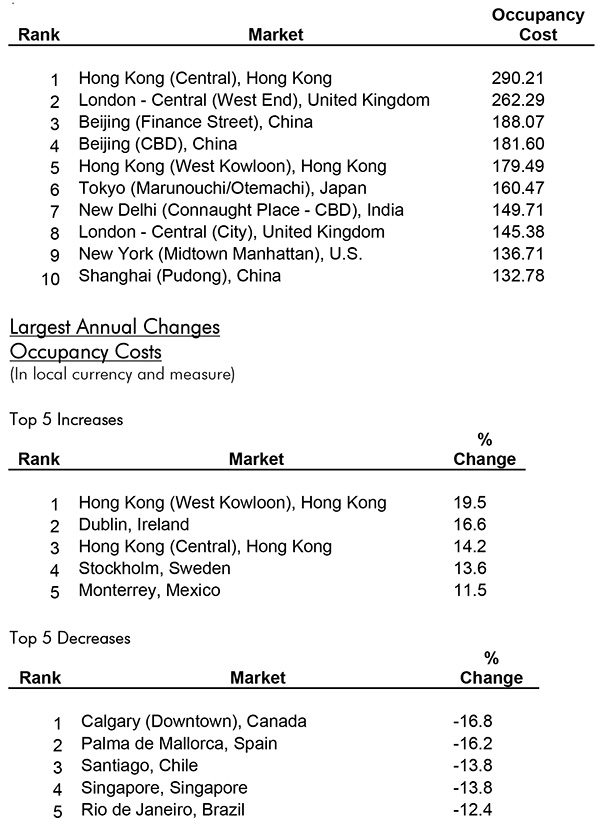

Hong Kong’s (Central) overall prime occupancy costs of US$290 per sq. ft. per year topped the “most expensive” list, displacing London’s West End (US$262 per sq. ft.). Beijing (Finance Street) (US$188 per sq. ft.), Beijing (Central Business District (CBD)) (US$182 per sq. ft.) and Hong Kong (West Kowloon) (US$179 per sq. ft.) rounded out the top five.

The study also found that the real estate recovery in Ireland continued to gain momentum, with Dublin, which experienced a 50 percent drop in rents during the downturn, showing the second-largest year-over-year prime occupancy cost increase among the 126 cities surveyed (up 16.6 percent year-over-year)—second only to Hong Kong West Kowloon (up 19.5 percent year-over-year). In North America, real estate fundamentals saw steady improvement with both Atlanta (Downtown) and Seattle (Downtown) among the 10 markets with the fastest growing prime occupancy costs.

Global prime office occupancy costs—which reflect rent, plus local taxes and service charges for the highest-quality, “prime” office properties—rose 2.4 percent year-over-year, with the Americas up 2.3 percent, EMEA up 2.1 percent and Asia Pacific up 2.7 percent.

“We expect the global economy to keep growing, and the global service sector, the primary occupier of prime office properties, will continue to expand through periods of volatility, “ said Richard Barkham, global chief economist, CBRE. “Since inflation is low, the growth in prime office occupancy costs is significant for both users and investors.”

CBRE tracks occupancy costs for prime office space in 126 markets around the globe. Of the top 50 “most expensive” markets, 20 were in Asia Pacific, 20 were in EMEA and 10 were in the Americas.

Europe Middle East & Africa (EMEA)

Europe is benefitting from a cyclical pick-up in consumer spending and business investment, as well as a very competitive currency and intense monetary stimulus, which helped to make Dublin, Stockholm and Barcelona the fastest-growing markets in the region. Most Central and Eastern European markets were down year-over-year, including Moscow, which is still in the midst of a recession. Costs accelerated quickly in South Africa, with Johannesburg, Cape Town and Durban all seeing increases of at least 6.9 percent from year-ago levels.

Only 11 out of 56 EMEA markets recorded a year-over-year decline in prime office occupancy costs.

In addition to London West End, the other market from the region in the global top 10 was London City (US$145 per sq. ft.).

Asia Pacific

Asia Pacific was home to seven of the top 10 most expensive markets—Hong Kong (Central), Beijing (Finance Street), Beijing (CBD), Hong Kong (West Kowloon), Tokyo (Marunouchi/Otemachi), New Delhi (Connaught Place – CBD), and Shanghai (Pudong).

The service sector will show particularly strong growth in Asia as pensions and insurance products gain market share. So occupancy cost growth will continue to trend upwards at a moderate pace.

Hong Kong (Central) is the only market in the world—other than London’s West End—with a prime occupancy cost exceeding US$200 per sq. ft. Hong Kong Central’s double-digit growth in occupancy costs was fuelled by two factors: an ultra-low vacancy rate due to lack of new development and continued demand for high-quality space in prime locations by mainland Chinese companies.

The most expensive market in the global ranking from the Pacific Region was Sydney (US$93 per sq. ft.), in 22nd place.

A few key Southeast Asian markets registered decreases, including Singapore and Jakarta.

Americas

In the Americas, four markets—Monterrey, Atlanta (Downtown), Seattle (Downtown) and Atlanta (Suburban)—recorded double-digit percentage gains year-over-year.

New York Midtown, number nine on the global list, remained the most expensive market in the Americas, with a prime office occupancy cost of US$137 per sq. ft.

Several energy-centric markets experienced material drops in occupancy costs, including Calgary (Downtown and Suburban), Houston (Suburban) and Denver (Suburban).

In the U.S., economic growth is expected to pick up in the next several quarters following a turbulent opening quarter. Overall, occupier activity sustained last year’s momentum, leading to an increase in occupancy costs in 17 out of 22 U.S. markets covered in this survey.

Mexico City remained the most expensive market in Latin America, posting an office occupancy cost of US$65 per sq. ft. and ranking as the 39th most expensive market globally. Both Brazilian markets, Rio de Janeiro and São Paulo, saw declines.

Note: The full Top 50 Most Expensive Markets chart is located at the end of this press release.

Notes

- The Global Prime Office Occupancy Costs report is a survey of office occupancy costs for prime office space in 126 cities worldwide.

- The latest survey provides data on office rents and occupancy costs as of March 31, 2016.

- The Largest Annual Changes rankings are based upon occupancy costs in local currency and measure. The Most Expensive ranking is based upon occupancy costs in US$ per sq. ft. per annum.

- The figures given in this release refer to occupancy cost. This represents rent, plus local taxes and service charges. The occupation cost figures have also been adjusted to reflect different measurement practices from market to market.

- Due to methodology changes, comparisons with figures in previously released reports are not valid.

- To obtain a full copy of the report or to arrange to speak with a CBRE expert, please contact Robert McGrath (robert.mcgrath@cbre.com).

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world’s largest commercial real estate services and investment firm (in terms of 2015 revenue). The Company has more than 70,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 400 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.com.

MEDIA CONTACT

Robert McGrath

Senior Director, Global Media Relations

+1 212 9848267

email

###