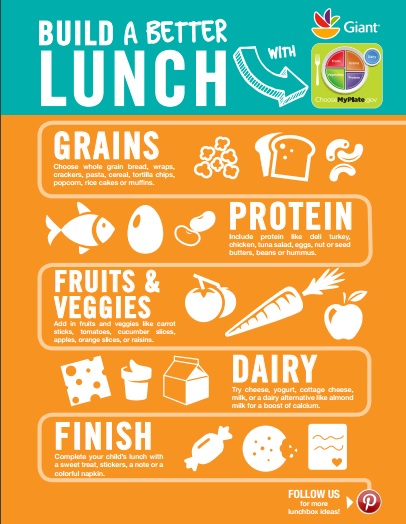

Landover, Md., 2016-Aug-01 — /EPR Retail News/ — To help families stay healthy and keep kids fueled during the busy summer season, Giant Food of Landover, Md. offers tips to build a better lunch for camps and other summer activities now - or for school lunches in the fall. With guidance from ChooseMyPlate.gov, Giant's licensed in-store…